As the summer period is approaching, we are glad to share a recap of the first half of 2023 with (1) evolution of market share across exchanges and MTFs, (2) the successful migration of Italian cash markets onto Optiq, as well as (3) the upcoming expansion of the Global Equity Market for pan-European and US stocks, and (4) the launch of dark trading and midpoint functionalities on Euronext Central Limit Order Book.

Highlights

Looking back...

- Continuous & auctions market share has improved for the main Regulated Exchanges on their respective ‘domestic shares’ in 2023, with Euronext increasing from 62.9% in January to 66.5% in June.

- The migration of Italian cash markets onto Optiq led to strong improvement of Euronext market quality as the venue for price formation, with Euronext Milan market share reaching the highest in 18 months – and EBBO Setting Percentage increasing from 50% to over 68%.

and looking ahead

- Euronext will expand its retail offering on the Global Equity Market (GEM) and Trading After Hours (TAH): over 300 pan-European and US shares will be available for trading from 07:30 to 20:30 CET, cleared and settled in Euros, with the same market microstructure and connectivity as Euronext main markets.

Euronext will launch dark, midpoint and dark-lit sweep functionalities on its Central Order Book by the end of 2023, at zero latency for dark-to-lit execution.

Market share increased for Regulated Exchanges in Europe

- All Primary Exchanges have gained market share from MTFs compared to the beginning of the year – both during the volatile Q1 and after the quiet Q2.

- Euronext has reached 66.5% market share - highest in the last 12 months.

*Continuous & Auctions market share on domestic stocks, including dark and periodic auctions.

Data source: IRESS Market Data

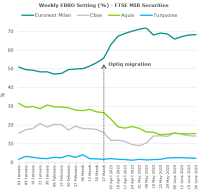

Euronext Milan market quality improved after Optiq migration

- Euronext reinforced its position as the venue of price formation following the migration of Italian cash equity markets to Optiq on 27 March 2023.

- Euronext Milan reached 73.8% market share in June 2023, the highest level over the last 18 months.

- Euronext EBBO Setting Percentage for FTSE MIB stocks increased from 50% in Q1 to 68% in Q2 – while each of the main MTFs now sets the best prices on Milan blue chips less than 15% of the time.

Data source: BMLL Technologies

Pan-European and US stocks on Euronext GEM

- Euronext Global Equity Market (GEM) is an MTF managed by Euronext already offering already 100+ European and US blue-chip stocks, with more to be added soon.

- Trading After Hours available until 20:30 CET, overlapping with US markets.

- Same connectivity, microstructure and trading platform as Euronext main markets.

- 40+ members connected already: retail banks, global brokers and market makers.

- A full revamp of Euronext GEM will take place after the summer, with a dedicated market making scheme and an expanded stock universe.

What do I need to start the membership process on Euronext GEM?- A set-up with Euronext Clearing (CC&G) is required - But you can start the membership process/paperwork now - No membership fees - No additional market data fees - No additional Logical Access fees – same connectivity you already use for Euronext main markets |

Euronext will launch dark, midpoint and sweep functionalities

- The latency between Euronext and London MTFs has multiplied by ~10 since the migration of the Euronext Data Centre from Basildon (UK) to Bergamo (Italy), thus Dark to Lit execution performance is deteriorating on MTFs.

- Euronext will launch dark functionalities to source liquidity in both trading pools (Dark and Lit) within the Central Order Book – not a separate MTF.

- Thanks to sweep functionalities, orders can be transferred to the Euronext Lit Central Limit Order Book in case of partial or no execution in the dark – at no latency.

- Timeline: Q4-2023 in test environment and Q1-2024 in production.

Focus on Latency – How long does it take for an order sent from London to reach the Euronext Data Centre in Bergamo?From 0.5 milliseconds before the Data Centre moved from London to Bergamo in June 2022, to 3-4ms (microwave) or 7-8ms (fibre) today. Data source: big xyt - Euronext will close this gap offering Dark to Lit execution at no latency, within the same Central Limit Order Book and leveraging on the Data Centre in Bergamo. |

The Euronext Equities team

In the news

The TRADE News - 16 May 2023

Euronext to launch dark trading and expanded retail trading services amid second best quarterly results in its history

New dark offering is aimed at reducing latency arbitrage for clients following the exchange’s data centre migration, Euronext’s Simon Gallagher and Vincent Boquillon told The TRADE.

Read the article

At conferences in H2-2023

- International TraderForum,

5-8 September, Barcelona - FIX Trading France,

14 November, Paris

Check out our insights on LinkedIn in H1-2023

Click on the links below:

What should be addressed in MiFIR Review

The TRADE Roundtable: Trading at the Closing Auction

The Price of Liquidity in Equities' panel at FIX EMEA 2023

For more information

Don't hesitate to contact your sales representatives with any queries or feedback.

Thank you!